Skip to main content

Search for topics or resources

Enter your search below and hit enter or click the search icon.

Products

Solutions

Solutions

Customers

Customers

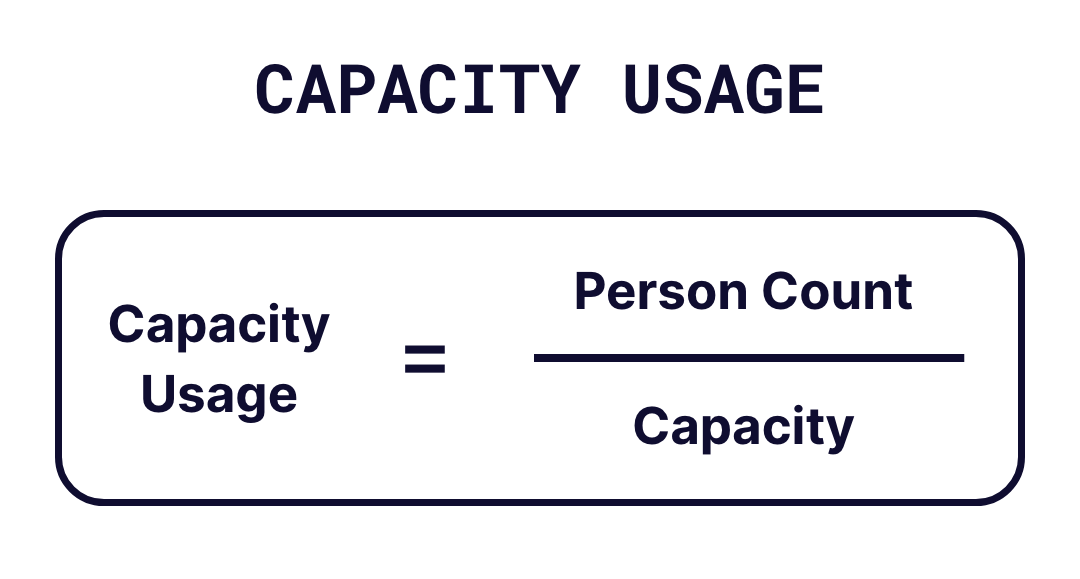

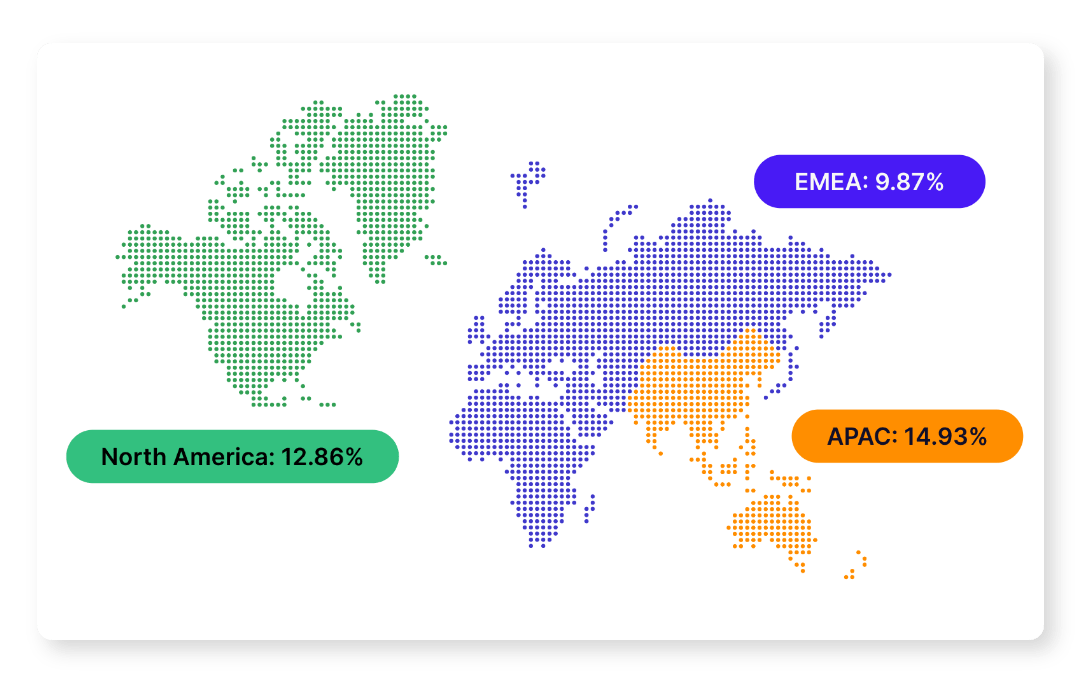

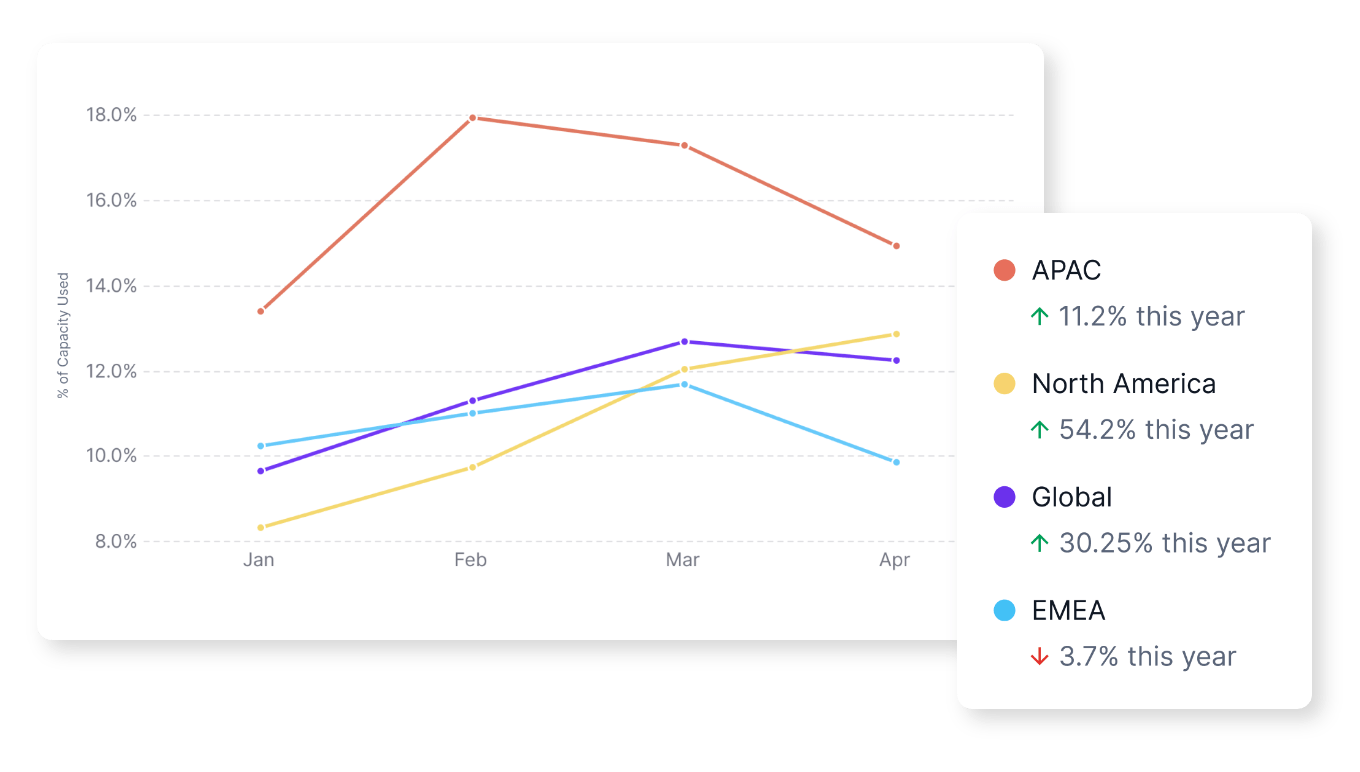

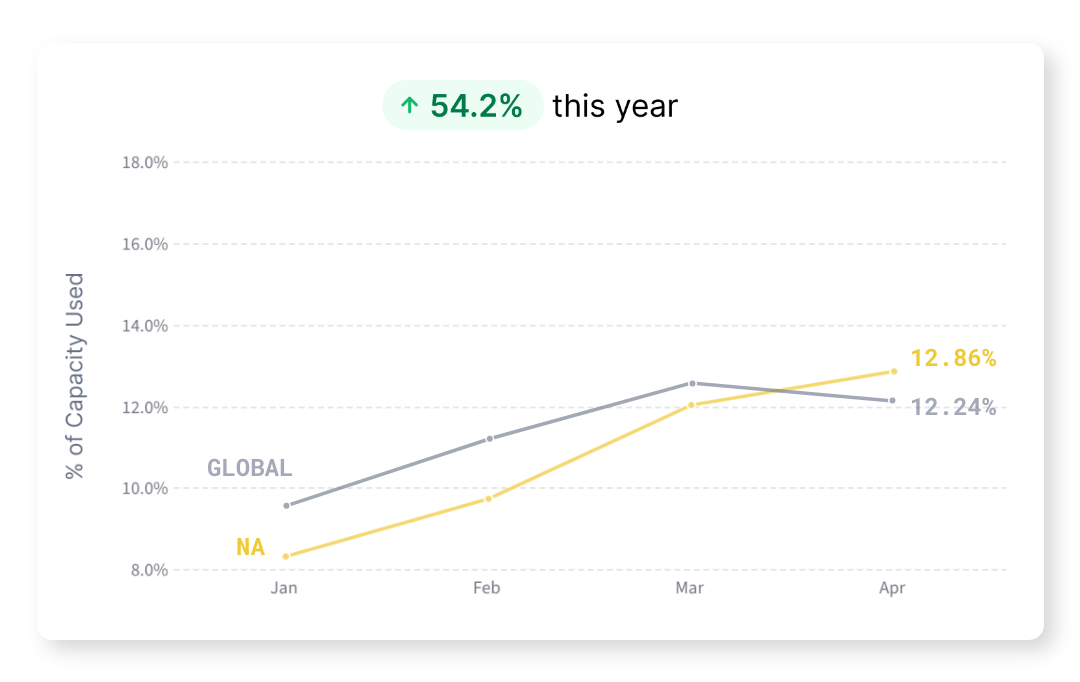

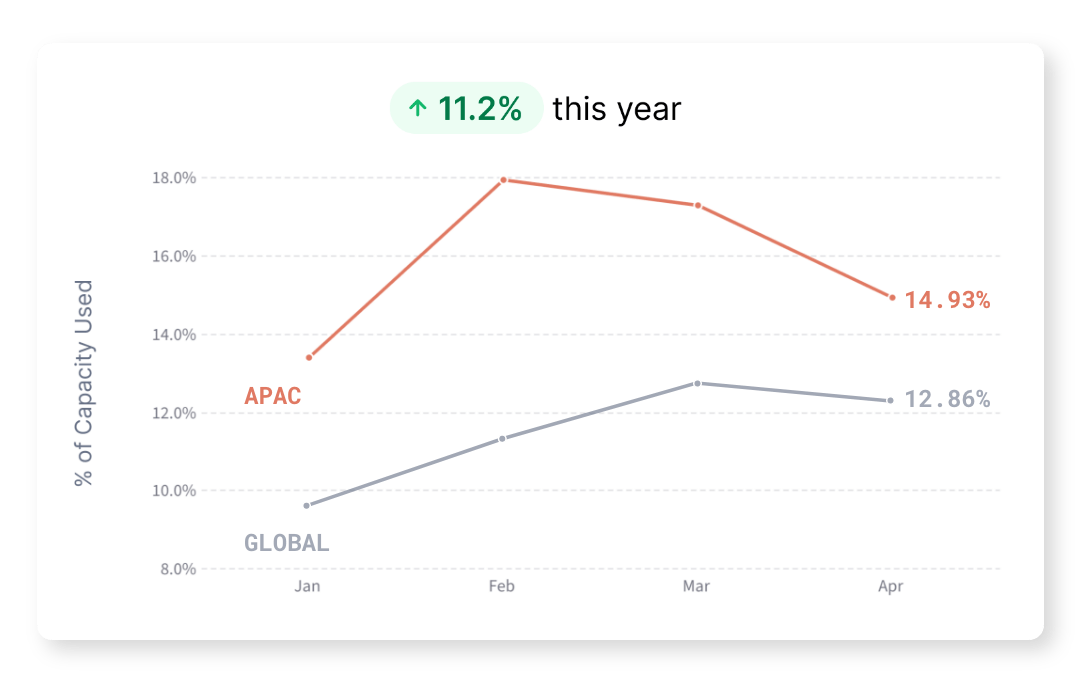

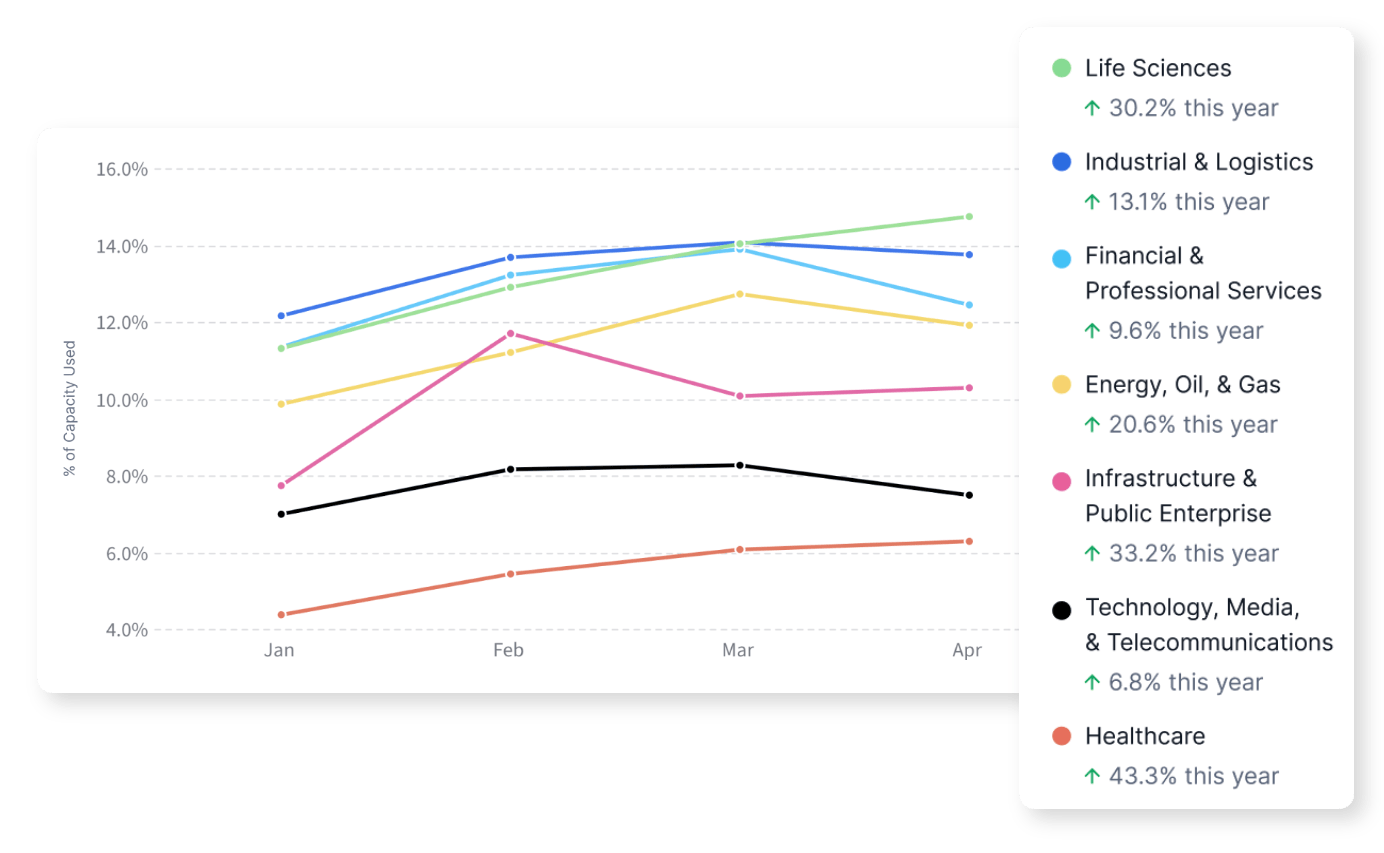

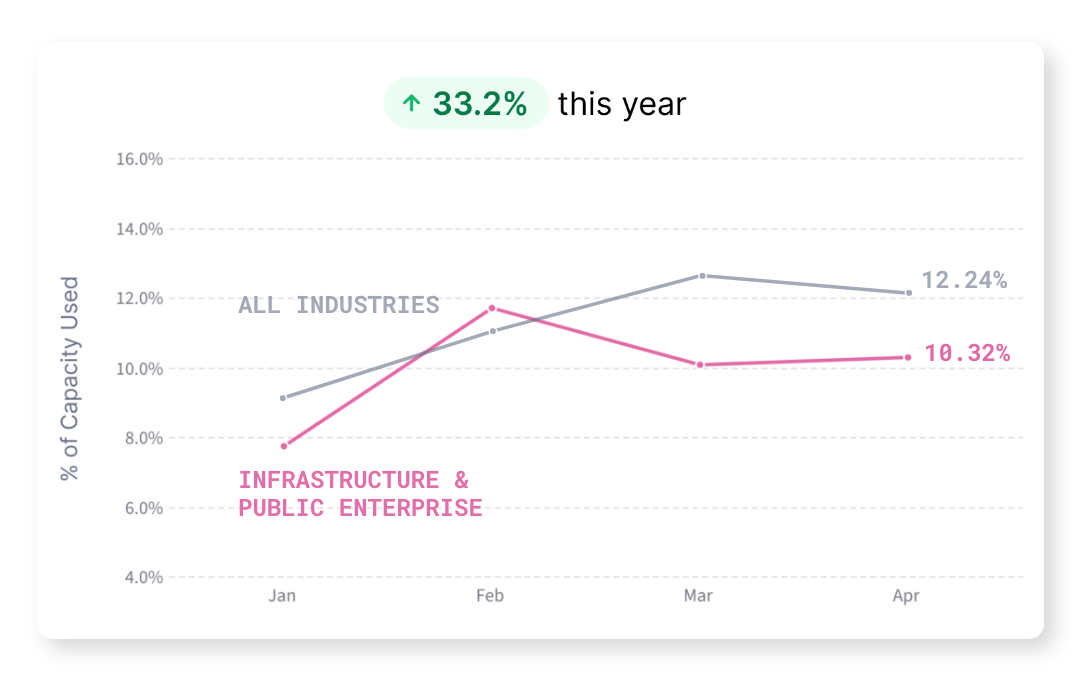

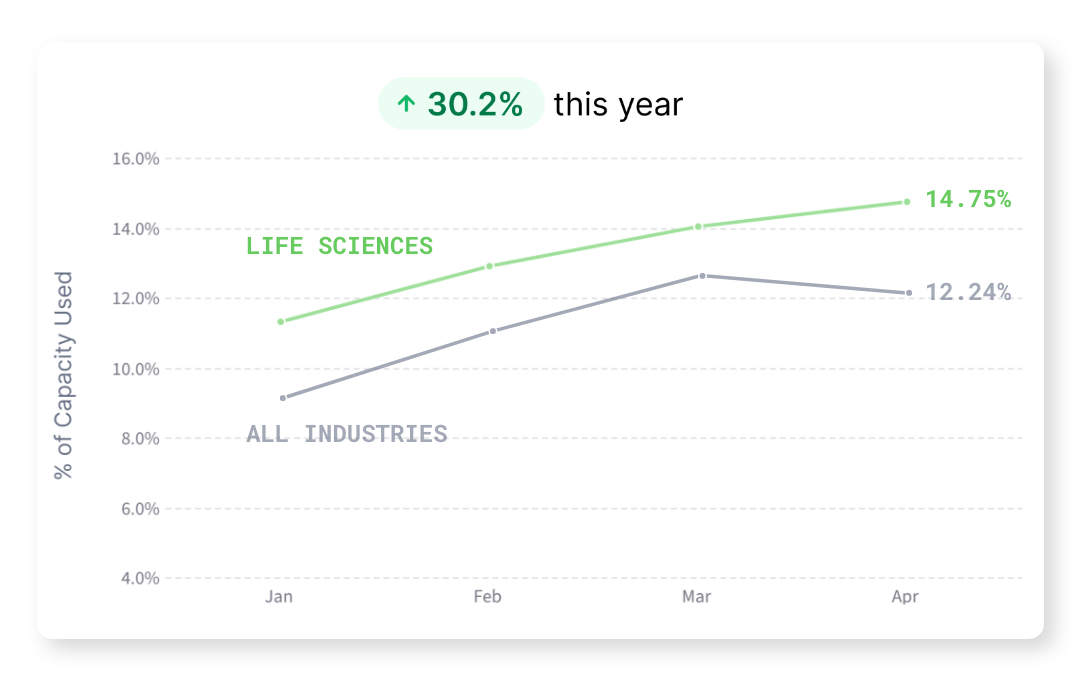

Overall, the global state of occupancy is increasing from a combined impact of return-to-office mandates, fewer remote job postings, and regional efforts to boost in-office collaboration. Globally, there was a small dip in capacity usage in April, likely influenced by public holidays and employees taking time off as the northern hemisphere nears summertime.

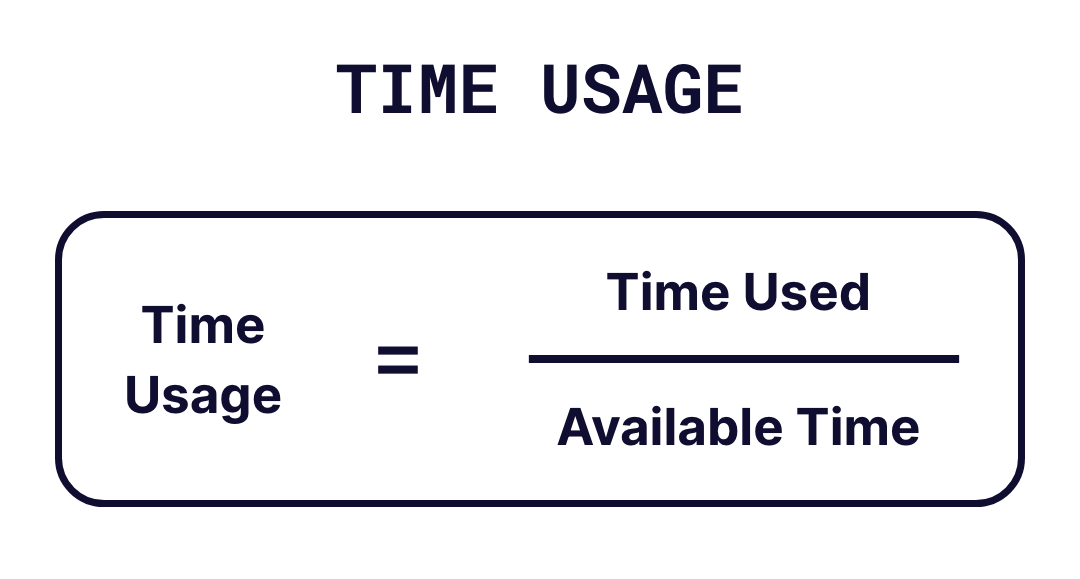

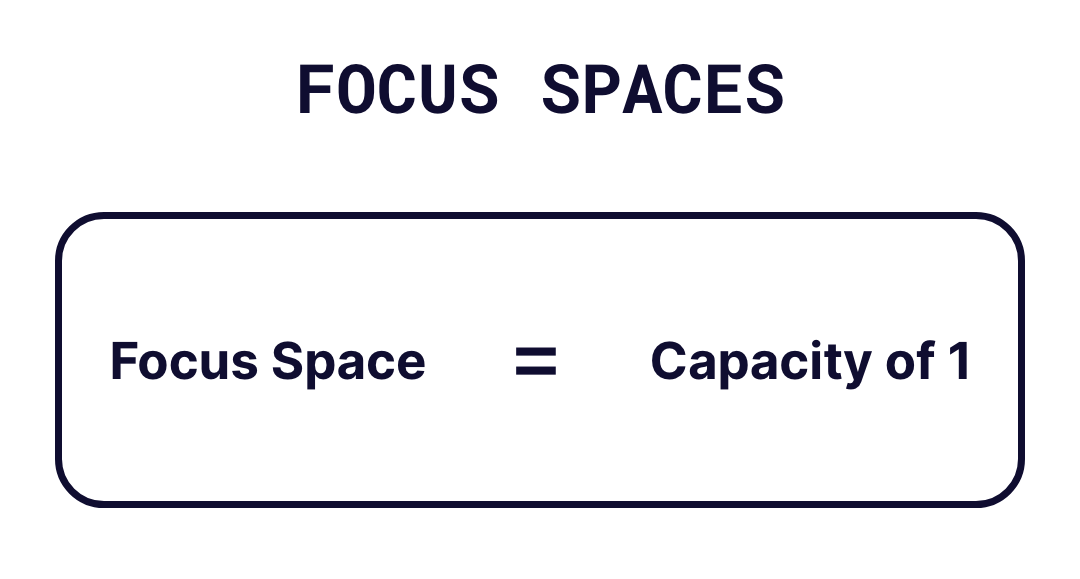

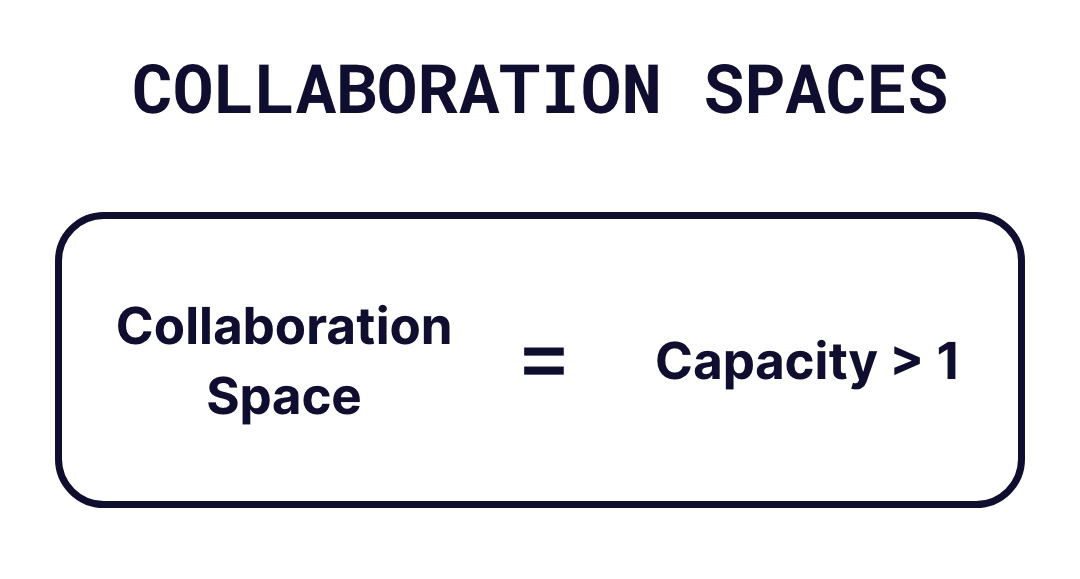

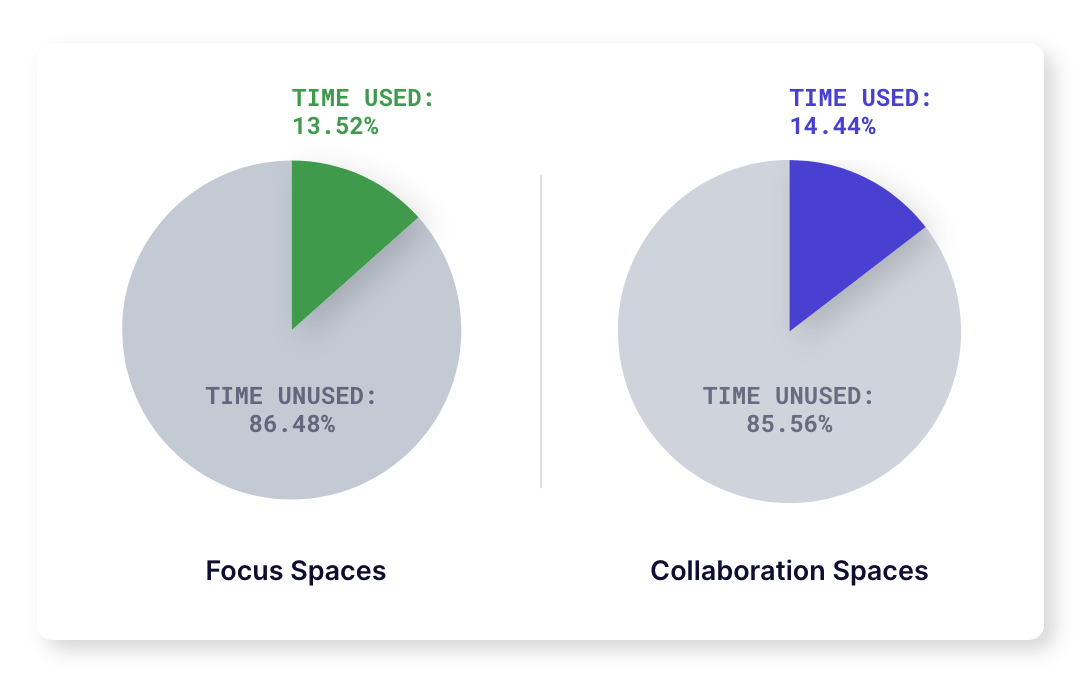

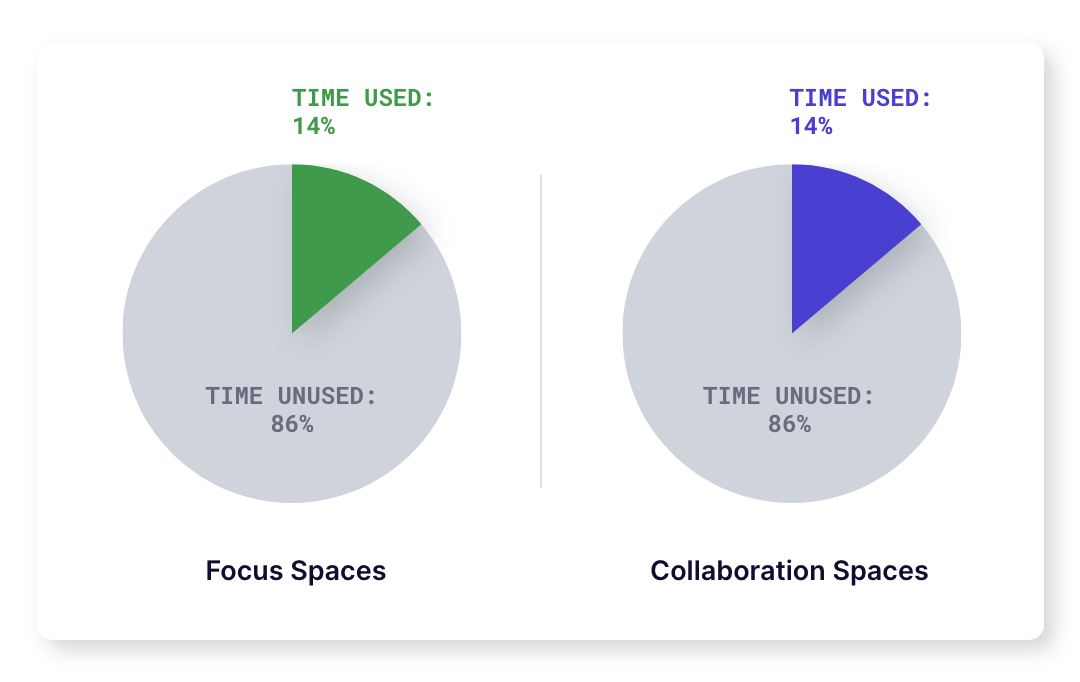

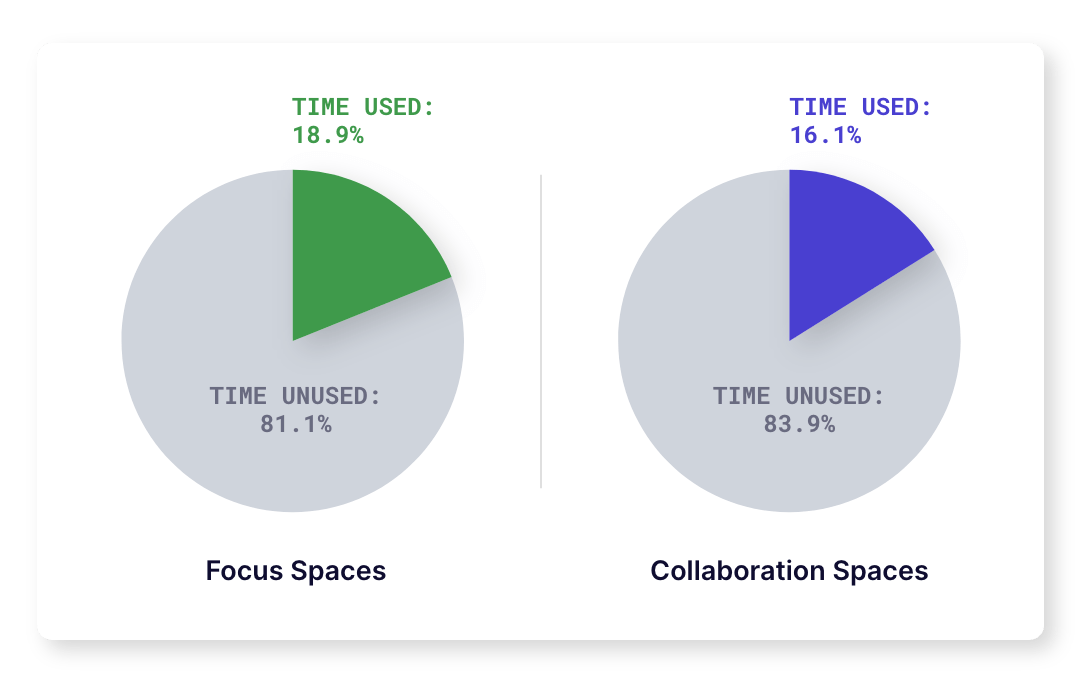

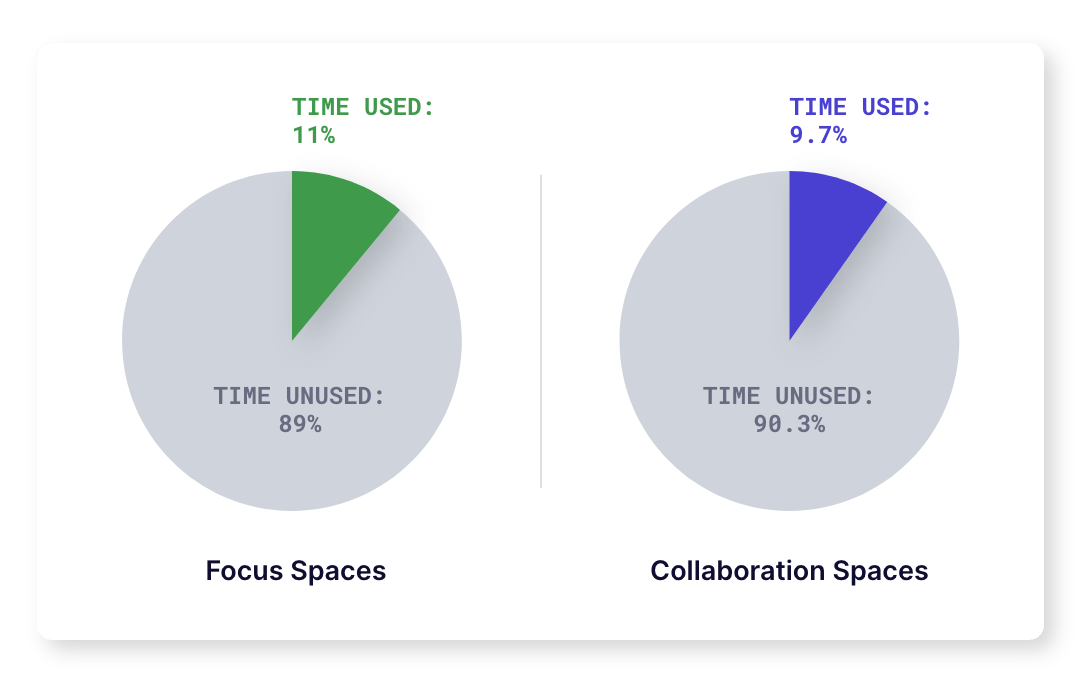

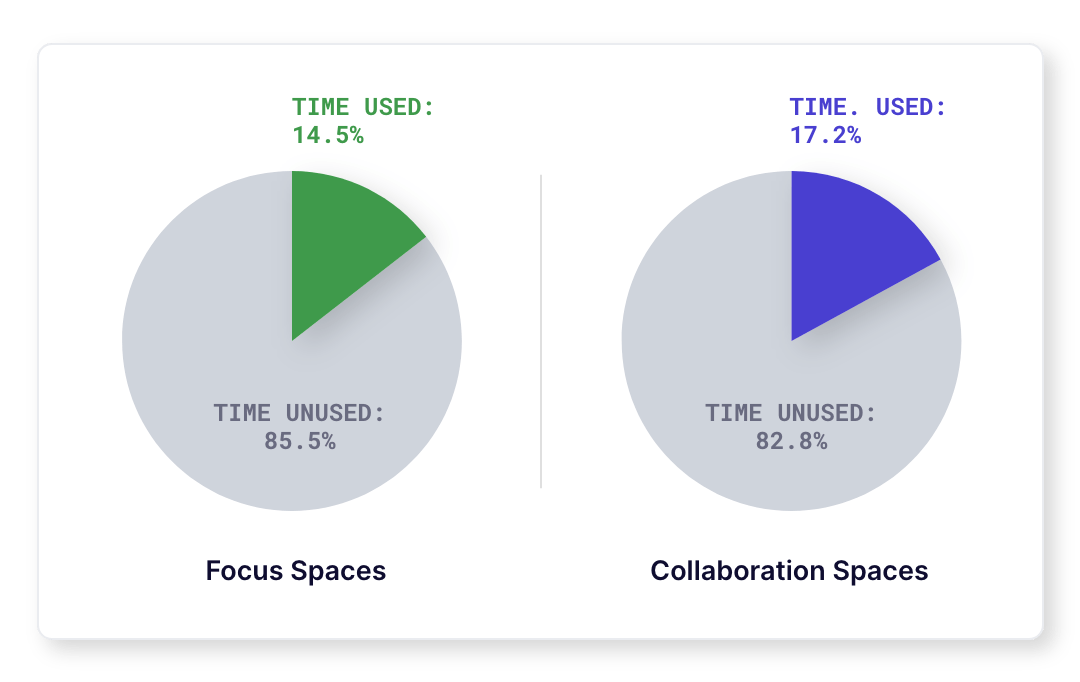

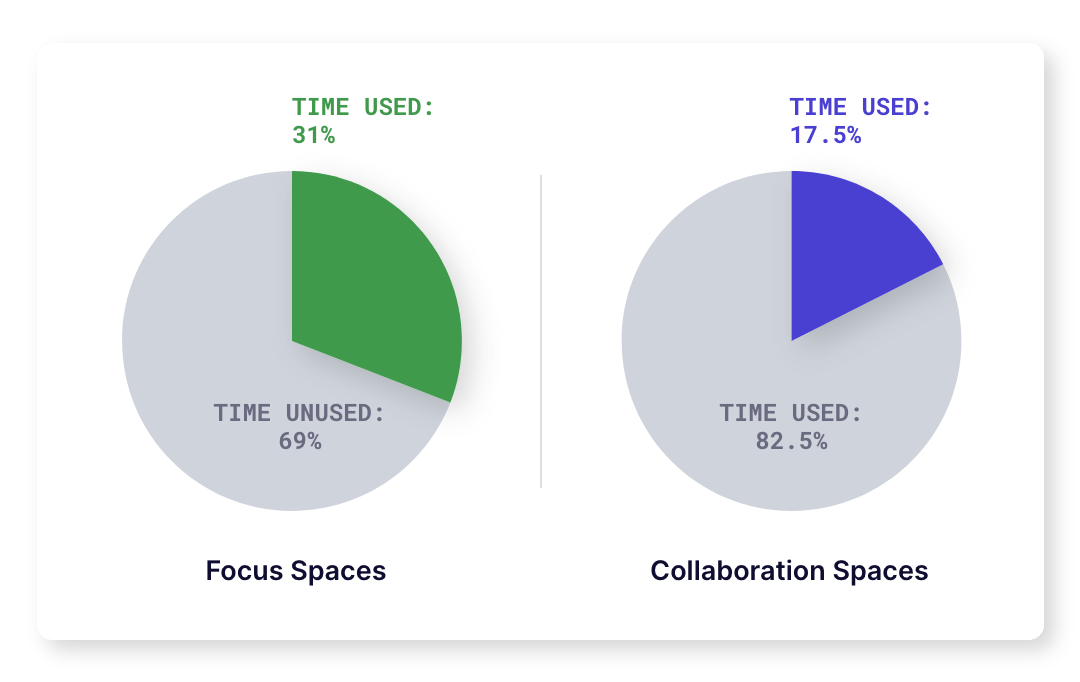

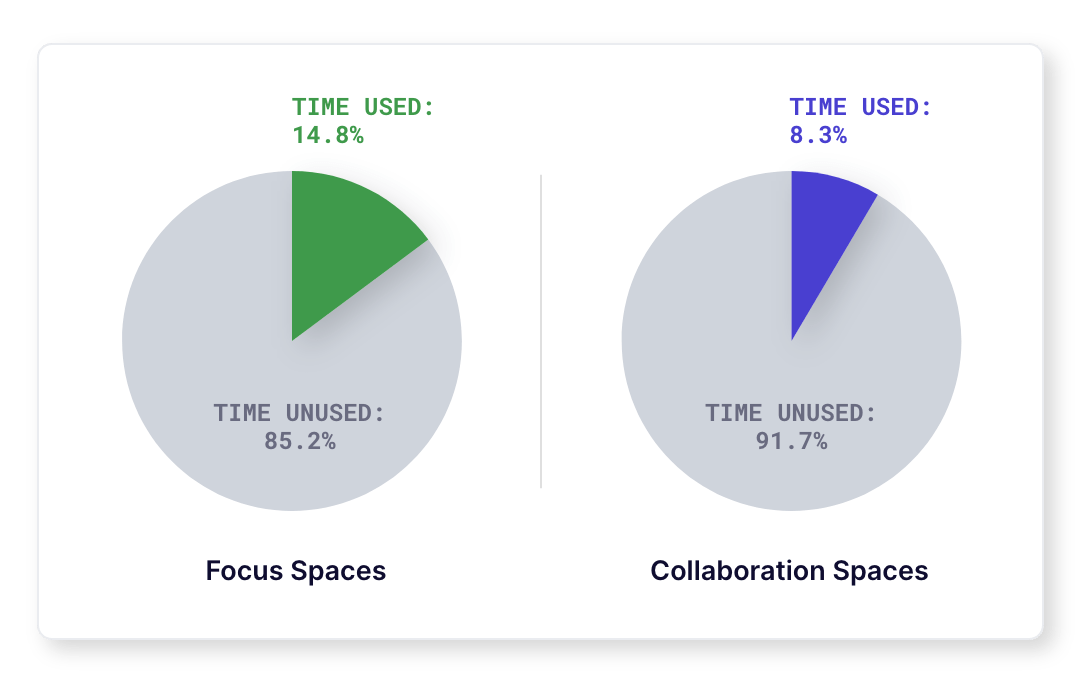

Overall, the global state of occupancy is increasing from a combined impact of return-to-office mandates, fewer remote job postings, and regional efforts to boost in-office collaboration. Globally, there was a small dip in capacity usage in April, likely influenced by public holidays and employees taking time off as the northern hemisphere nears summertime. Globally, collaboration spaces are being used a bit more frequently than focus spaces, showing that employees are utilizing in-person workdays as opportunities to collaborate with their teammates rather than just working heads-down or attending virtual meetings.

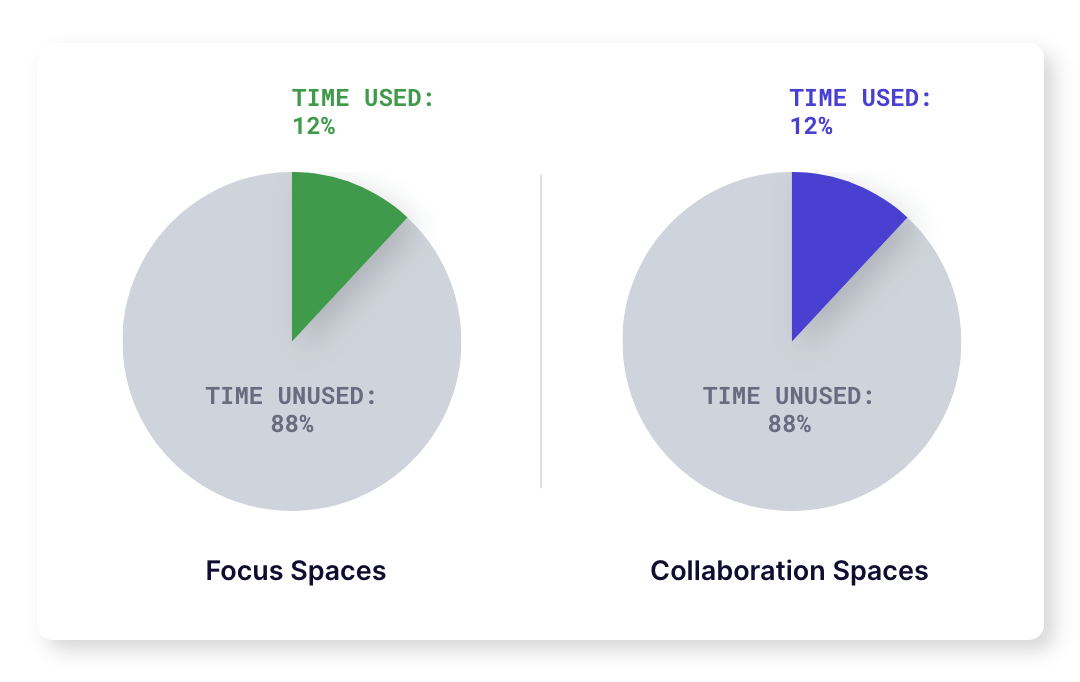

Globally, collaboration spaces are being used a bit more frequently than focus spaces, showing that employees are utilizing in-person workdays as opportunities to collaborate with their teammates rather than just working heads-down or attending virtual meetings.

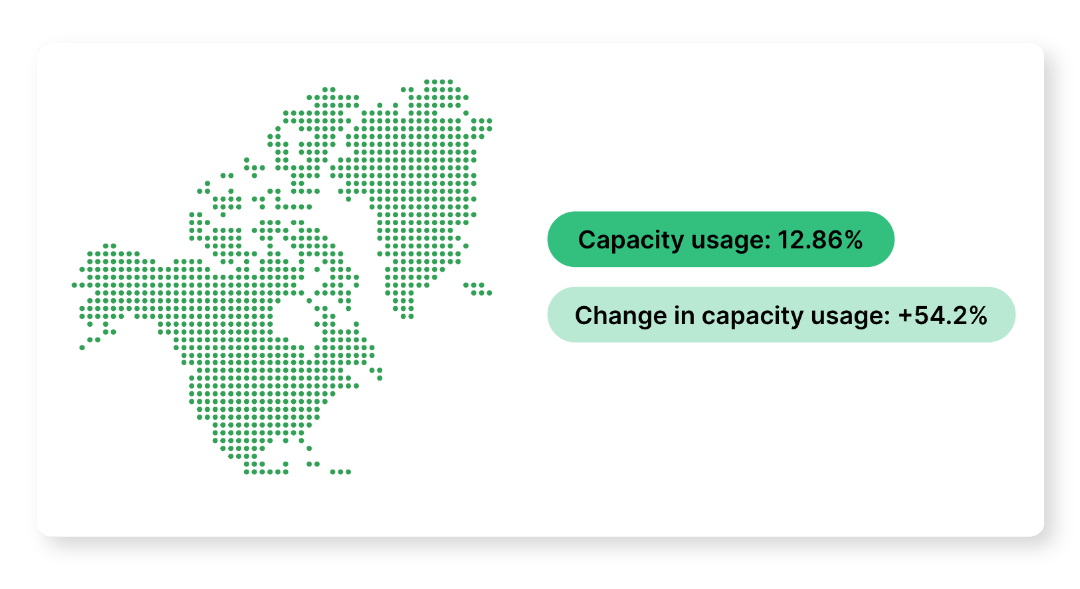

North America shows lower usage of collaborative spaces compared to other regions. All regions, but especially North America, have faced the challenge of their employees continuing to attend virtual meetings when working in-office, which could also be driving down the use of collaborative spaces.

North America shows lower usage of collaborative spaces compared to other regions. All regions, but especially North America, have faced the challenge of their employees continuing to attend virtual meetings when working in-office, which could also be driving down the use of collaborative spaces.

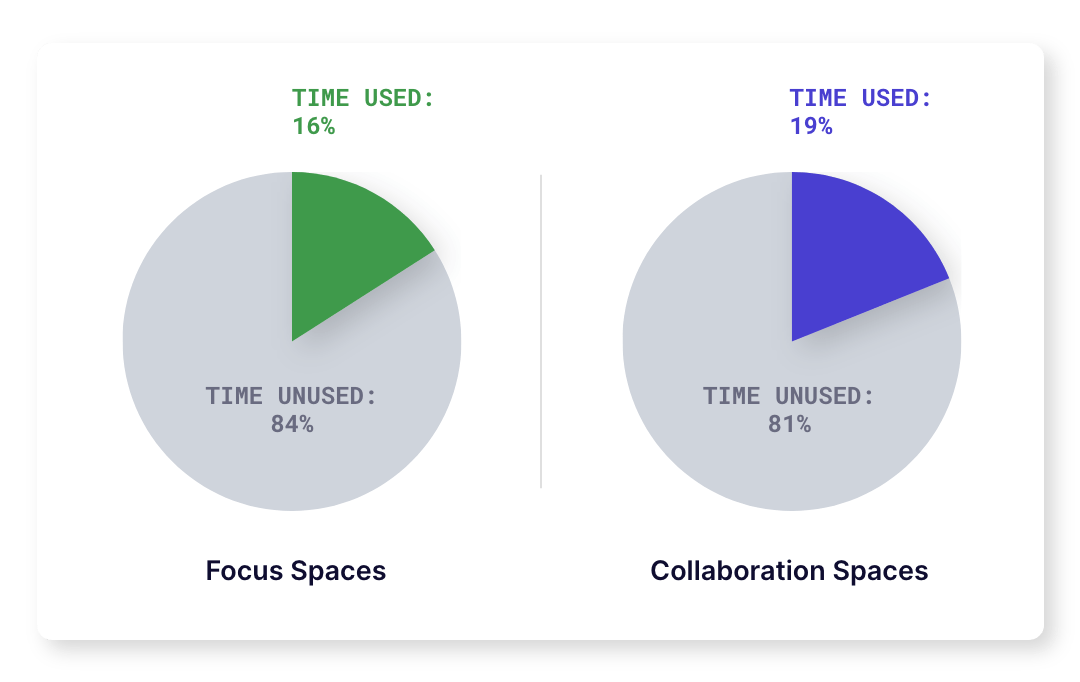

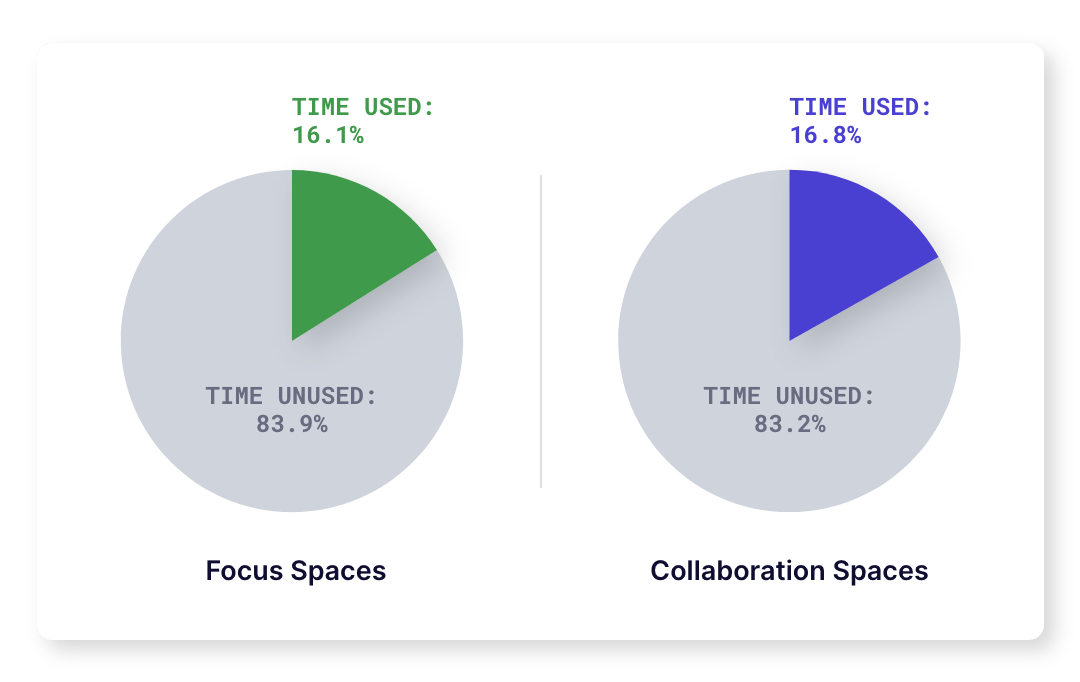

Compared to all other regions, EMEA is spending the most time in collaboration spaces, suggesting that EMEA primarily uses in-office time to collaborate versus remotely.

Compared to all other regions, EMEA is spending the most time in collaboration spaces, suggesting that EMEA primarily uses in-office time to collaborate versus remotely.

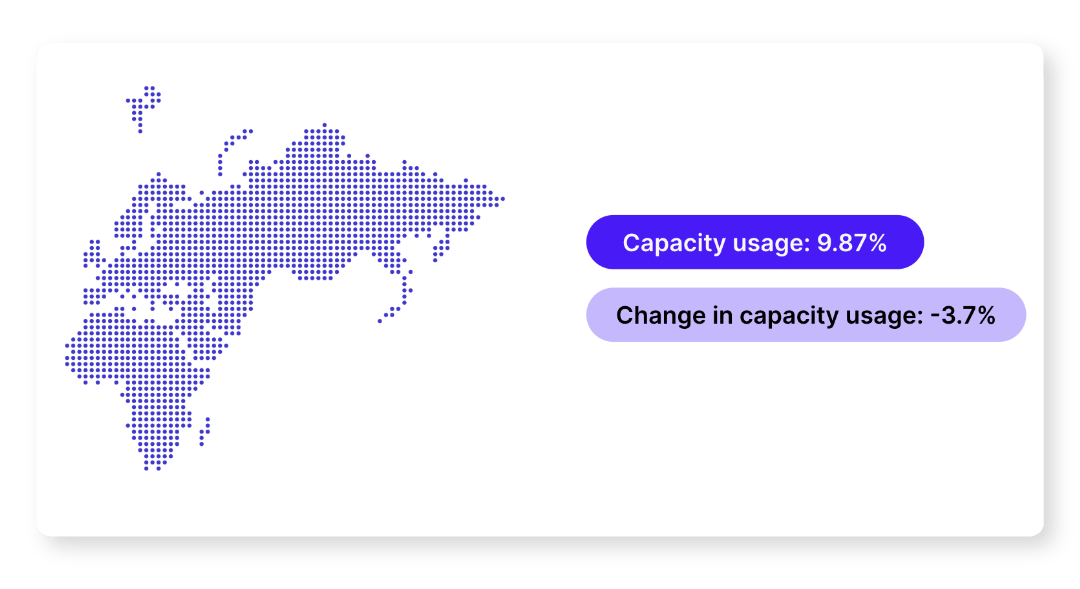

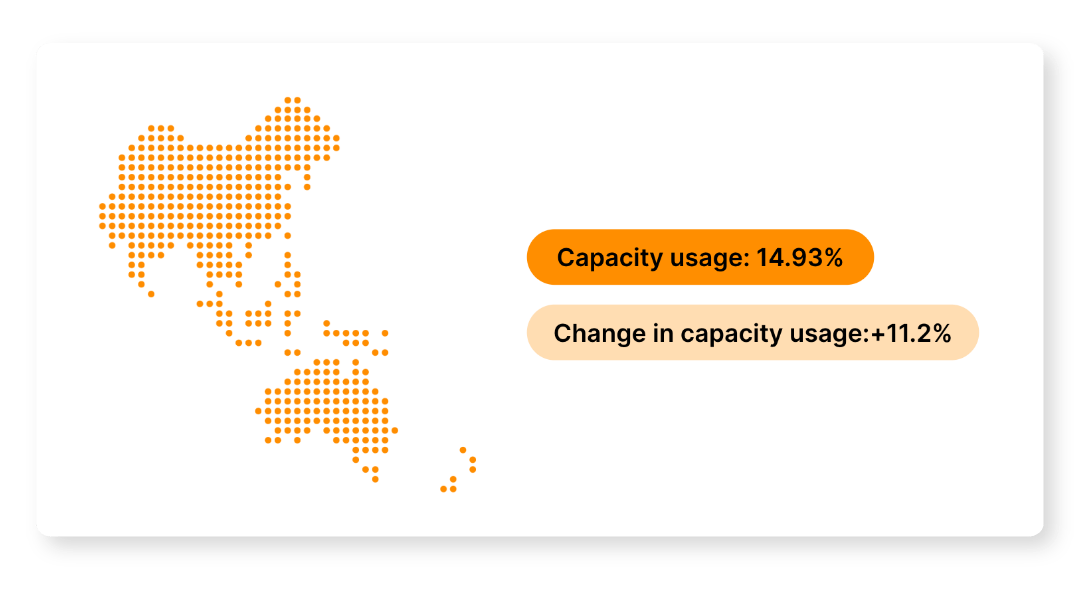

APAC saw notable growth between January and February, but since, capacity usage has slowly dropped, leading to overall growth of 11.2% so far this year.

APAC saw notable growth between January and February, but since, capacity usage has slowly dropped, leading to overall growth of 11.2% so far this year.  APAC has lower usage of collaborative spaces. In APAC, many meetings are held over meals, which may contribute to fewer collaborative spaces being used in-office.

APAC has lower usage of collaborative spaces. In APAC, many meetings are held over meals, which may contribute to fewer collaborative spaces being used in-office.

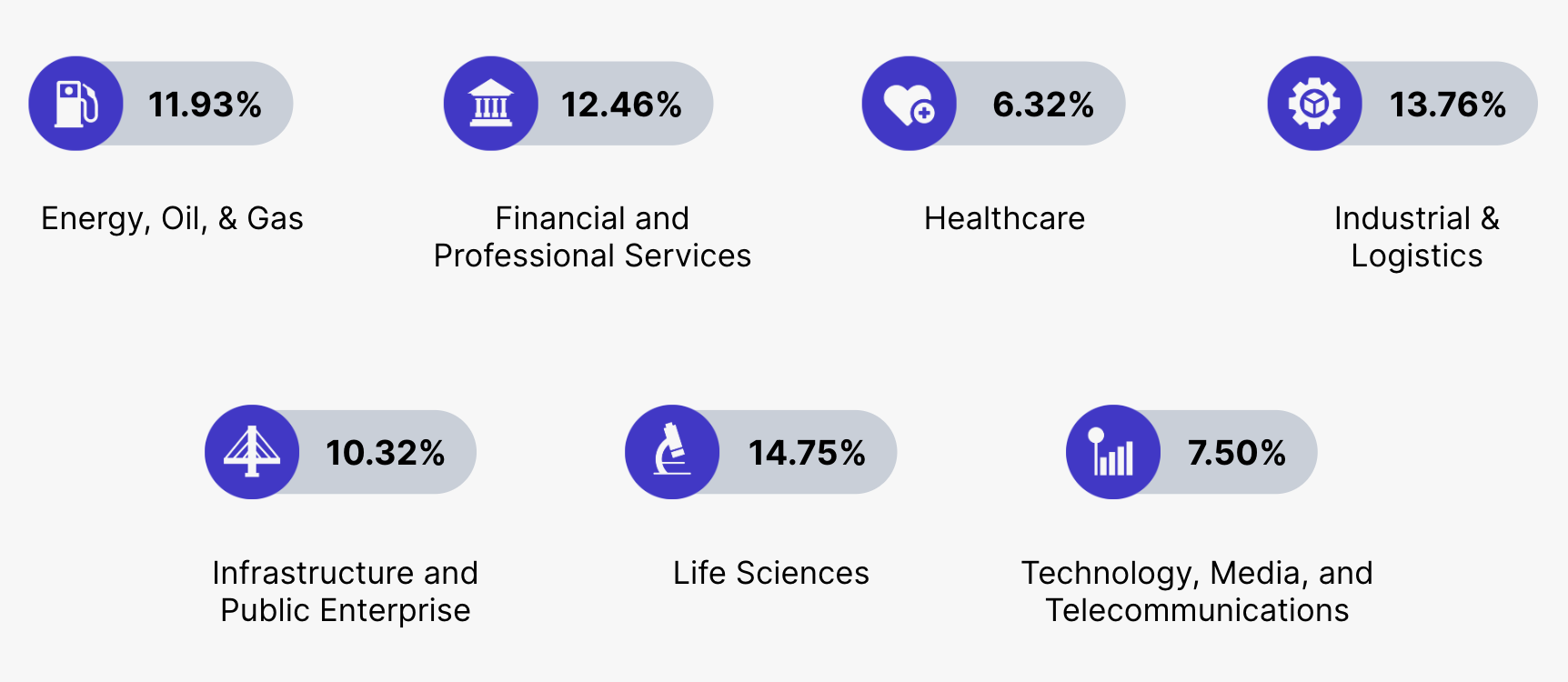

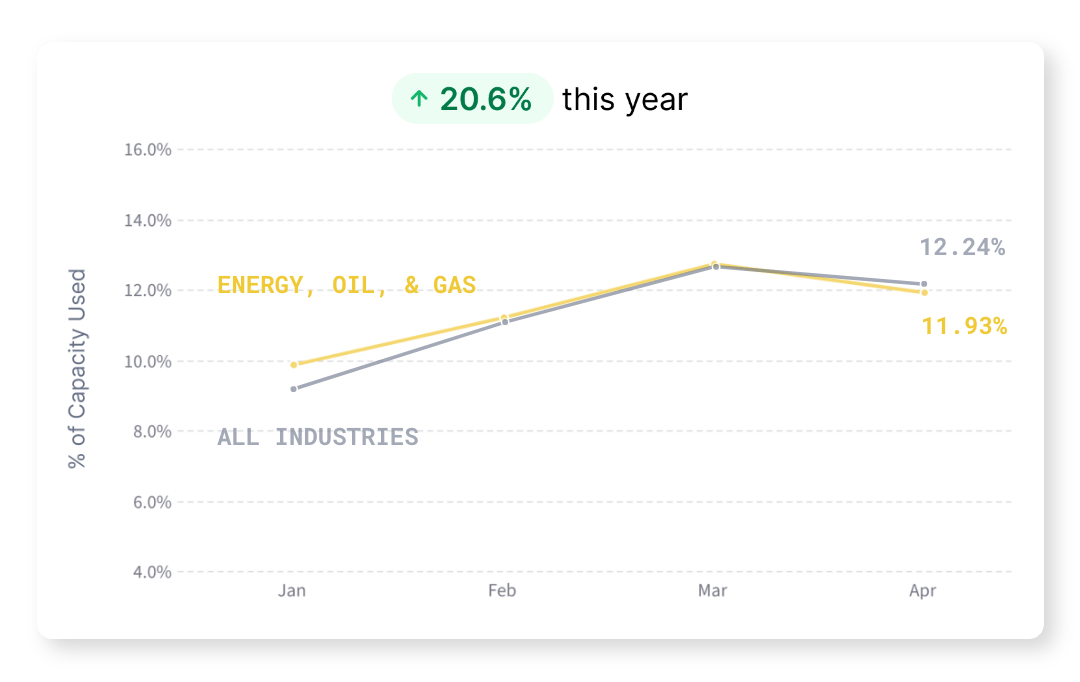

The Energy, Oil, and Gas sector is pacing closely with the global average in both capacity usage and growth. This industry also saw a small dip in usage in April, as many other industries and regions as a whole did.

The Energy, Oil, and Gas sector is pacing closely with the global average in both capacity usage and growth. This industry also saw a small dip in usage in April, as many other industries and regions as a whole did.

The Financial and Professional Services industry has faced significant resistance to returning to office, leading to the use of mandates, which have not been followed by everyone, as shown by slow growth.

The Financial and Professional Services industry has faced significant resistance to returning to office, leading to the use of mandates, which have not been followed by everyone, as shown by slow growth.

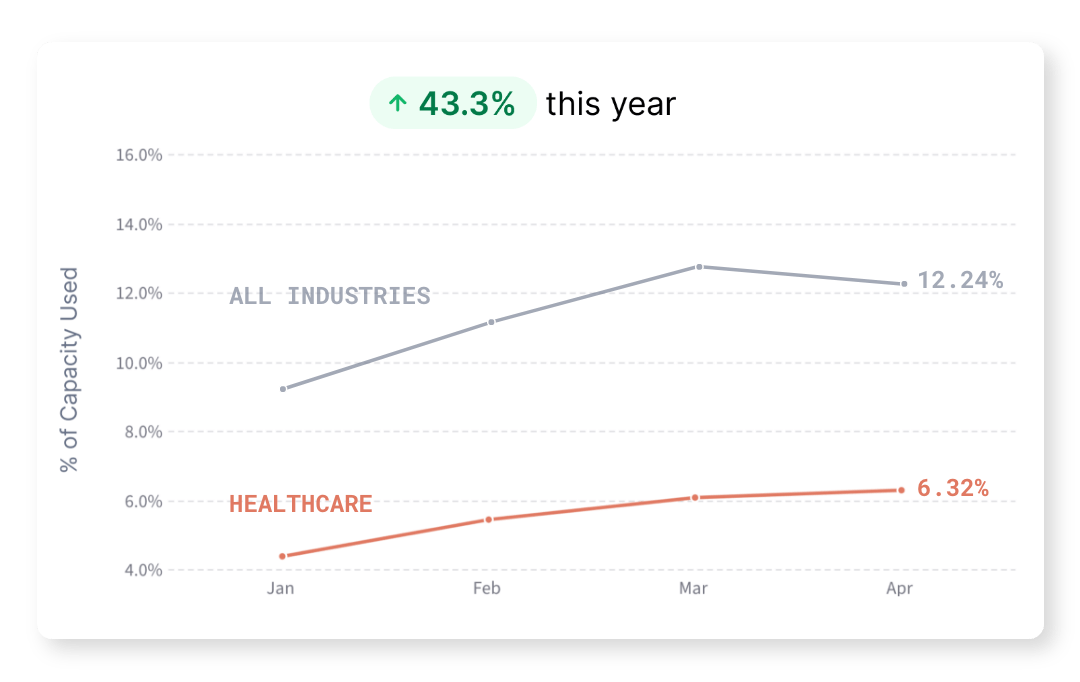

Healthcare has the lowest capacity usage among all measured industries. This low usage is due to a large prevalence of administrative and support roles in corporate healthcare that can be completed remotely. The emergence of telehealth has also created more remote and hybrid work opportunities for a historically in-person industry.

Healthcare has the lowest capacity usage among all measured industries. This low usage is due to a large prevalence of administrative and support roles in corporate healthcare that can be completed remotely. The emergence of telehealth has also created more remote and hybrid work opportunities for a historically in-person industry.

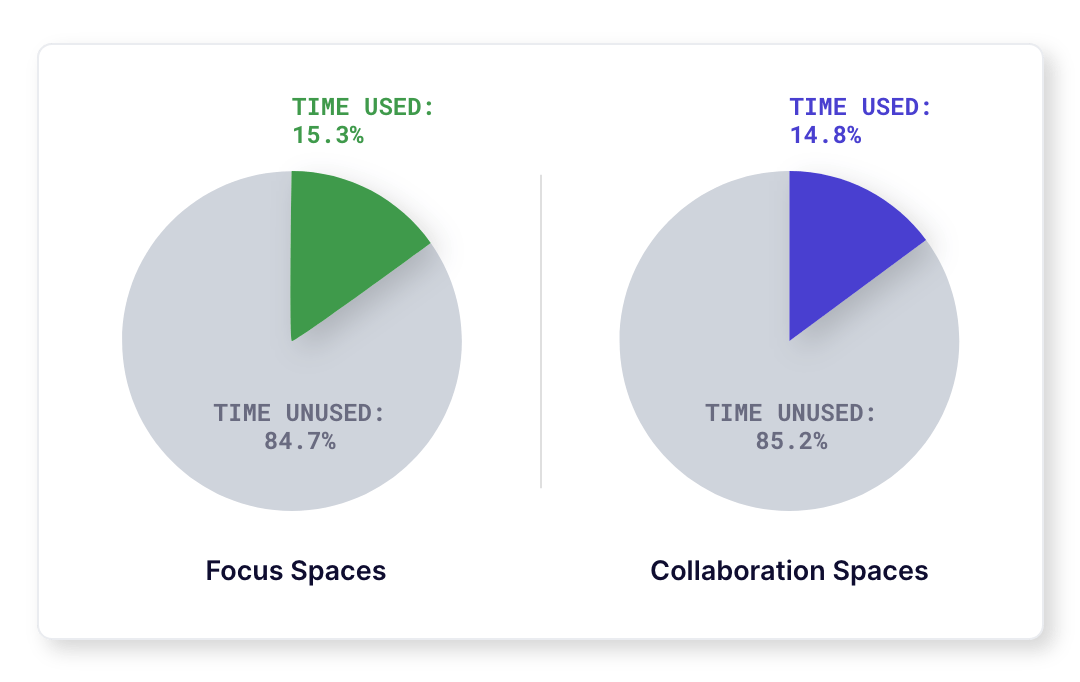

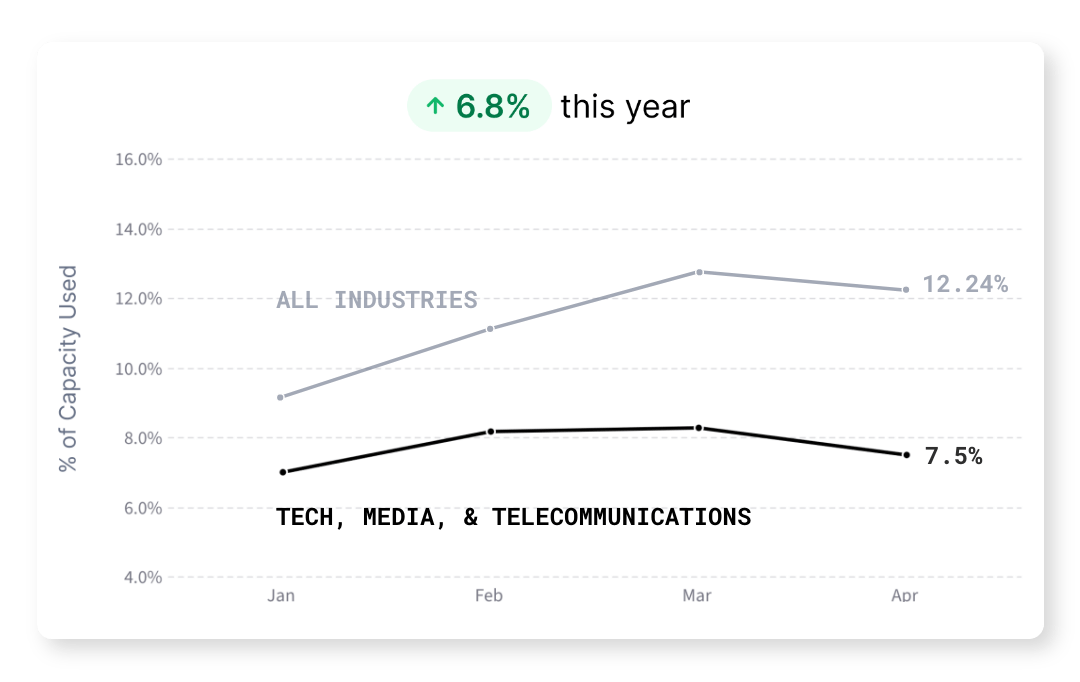

The technology, media, and telecommunications industry has the lowest capacity usage, as their focus on non-physical products (like software) enables remote work. The digital presence of their products has led to more flexible work environments and slow industry growth.

The technology, media, and telecommunications industry has the lowest capacity usage, as their focus on non-physical products (like software) enables remote work. The digital presence of their products has led to more flexible work environments and slow industry growth.

.jpg?width=1080&height=943&name=Talk-to-specialist-min%20(1).jpg)